Yesterday the International Sustainability Standards Board (ISSB) released the long-awaited detail on its first two standards:

IFRS S1: General Requirements for Disclosure of Sustainability-related Financial Information – Aims to support disclosures of financially relevant its sustainability-related risks and opportunities that are useful to primary users of general purpose financial report, such as investors. It is broadly structured in a similar format to the Task Force on Climate-related Financial Disclosures (TCFD) framework however, importantly these parameters which were previously only applied to climate risk will now be applied to all material sustainability related risks and opportunities.

IFRS S2: Climate-related Disclosures – Incorporates the recommendations of TCFD and includes climate-related industry-specific topics from the Sustainability Accounting Standards Board (SASB). It requires disclosure of Scope 3 emissions in addition to Scope 1 and 2 and outlines disclosures for transition planning and climate resilience.

The scope of both of these standards is financially-relevant sustainability information, as opposed to GRI, which covers all material (from an impact perspective) sustainability topics.

A statement on the release can be reviewed here, including a handy summary video half way down the page. The full disclosures can be reviewed here (you need to register to download them) and additional standards will be added to this page over time.

If you’re planning on reporting against ISSB we would encourage you to review in detail. However, its pretty dense so if you’re short on time (which we know you are) then we’ve pulled out the key highlights here for you to know.

What’s exciting about it?

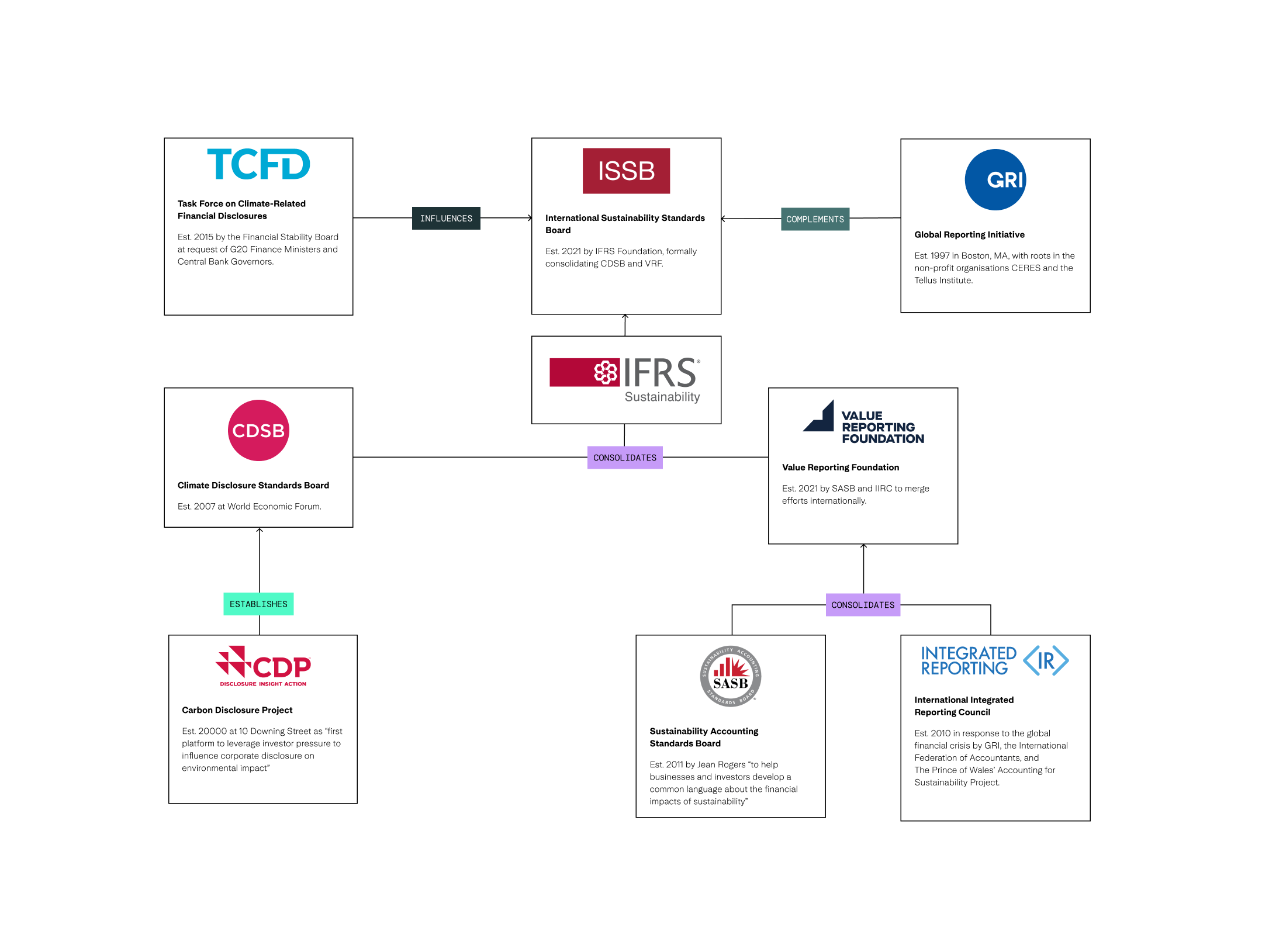

The ISSB brings excitement to sustainability reporting by addressing common criticisms. It aims to harmonise and consolidate sustainability reporting globally, improving the comparability and consistency of sustainability reports (see inset below). In reporting against the ISSB in conjunction with GRI, reporting entities take a double materiality approach, ensuring that reporting speaks to investors and other stakeholder groups such as customers and consumers.

The graphic depicts how the different sustainability related standards interrelate, showing that the IFRS wraps up a range of investor-driven disclosures and frameworks such as CDP, SASB and IR and their reporting boards, while being the standard issued by ISSB, the standard governance body. Both IFRS standards are heavily influenced by the structure of the TCFD framework and IFRS 2 draws on TCFD's framework content. GRI and ISSB sit alongside each other and complement one another through fulfilling the impact materiality (GRI) and financial materiality (ISSB) aspects of double materiality, and informing sustainability reports and integrated report content. The IFRS standards draw on the principles of GRI in its own principles of comparability, verifiability, timeliness and understandability.

How the pieces fit together….

What you need to know:

Reading through the standards in detail there are some elements that should be noted for any organisation thinking of reporting to ISSB in the future:

Time and location of reporting: The reporting of these standards must be published as part of or at the same time as the entity’s financial reporting (i.e. at the same time) and as part of general purpose financial reports. This supports integrated reporting, in line with the Value Reporting Foundation and International Integrated Reporting Council guidance. However, IFRS S1 does not mandate that the entities financial statements be prepared in accordance with IFRS Accounting Standards (as long as they are aligned with a generally accepted accounting principles or practices - GAAP).

Materiality of risks and opportunities on financial performance: Like GRI, ISSB requires a materiality assessment to determine the prioritisation of sustainability related risks and opportunities. Unlike GRI:

- ISSB’s focus is the financial materiality of sustainability-related risks and opportunities by considering potential impacts on an organisation’s cashflow and the likelihood of these impacts.

- ISSB does not outline a specific methodology that reporting entities should follow, unlike the voluntary guidance outlined by GRI 3. The requirement from ISSB for organisations to assess the financial materiality of sustainability-related risks and opportunities implies that organisations will need to undertake financial analysis as part of double materiality approaches.

Strategy & Risk Management: This release has further expanded on the requirement to demonstrate that the reporting entity has strategies in place to manage and mitigate identified and emerging risks and realise opportunities within its management approach. Importantly, the requests about risk management have specifically called out the need for scenario analysis to inform identification of sustainability related risks. This sees ISSB applying the risk language and assessment framework used by TCFD.

Disclosure of impact on financial performance: The standard specifically requires reporting entities to disclose quantitative and qualitative information about how sustainability-related risks and opportunities have affected its financial position, financial performance, and cash flows for the reporting period. While we knew this would be required under TCFD, this now applies to all sustainability related topics, and is probably the single biggest disruptor of this framework.

Transparency on judgement, uncertainties and errors: The standard has been more specific on the requirement for organisations to provide transparency on assumptions and uncertainties that might be included in reporting, particularly emissions reporting. This essentially will require more rigour around emissions reporting and for organisations to be clear about any errors that might have been made in reporting in the past.

Requirement to report on scope 3: IFRS S2 incorporates the recommendations of TCFD and includes climate-related industry-specific topics from the Sustainability Accounting Standards Board (SASB). As per the TCFD, this includes disclosure of physical and transitional climate risks and mitigation of these over time. However, importantly it also requires disclosure of Scope 3 emissions in addition to Scope 1 and 2. The standard outlined the detail on the methodology to calculate this, broadly in line with the Greenhouse Gas Protocol.

Where to start?

At Edge Impact, we assist clients in developing templated reporting processes, simplifying, and streamlining the reporting experience. We also help clients take a holistic approach, tailoring the reporting to the specific audience and balancing data and disclosure with storytelling and inspiration.

The release of the standards now gives organisations 12 months to prepare for reporting against these in next year’s financial reporting season. That give organisations who might not be prepared to get the fundamentals ready. To get the ball rolling we would recommend:

- Get your governance and strategy fundamentals in place: If you haven’t done this already, document your approach to assessing sustainability related risk and opportunities. This includes your materiality assessment process, your risk assessment process, and the underlying governance to overseeing these. This may require your organisation to further integrate assessment of non-financial risks into existing risk management and forecasting processes. Hopefully this is already addressed through your ESG strategy.

- Conduct a climate risk assessment: As per the requirements of TCFD, the most basic requirement of IFRS2 is an assessment of physical and transitional risks. This can be a relatively straightforward process and a good place to start.

- Develop a full carbon footprint, including scope 3: We always knew the requirement for scope 3 reporting would come, now it is here. This can require a bit more time and effort than scope 1 & 2 so make sure you plan for the resources and time to do this.

- Consider your approach to understanding the potential financial impact of sustainability-related risks and opportunities. This requires forecasting the investment required, financial value, and potential costs (e.g., fines due to ill-preparedness for changing regulations) of sustainability related risks and opportunities for your business, and positions sustainability as a core part of your organisation’s bottom line.

- Build understanding, awareness, and consensus. Undertaking alignment with new reporting frameworks can be daunting and we’re here to help bring your teams up to speed, facilitate consensus around measurement methodologies and build buy-in for taking the next step towards ISSB reporting.

Get in touch and learn how we at Edge Impact can help you get prepared for what’s to come.